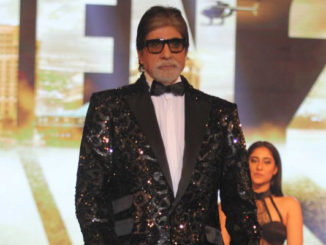

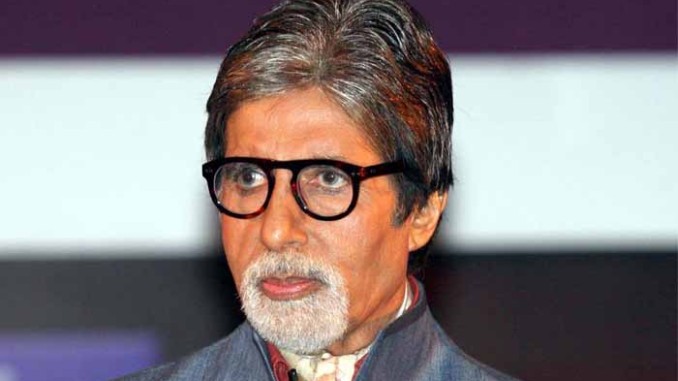

Amitabh Bachchan’s income tax issues during the ‘Kaun Banega Crorepati’ regime of 2001, allegedly worth Rs 1.66 crore, was challenged in the Supreme Court by the Income Tax department. The SC has ruled aside Bombay High Court’s order which gave tax relief to Bachchan in 2001 in a case involving his income from the TV show ‘Kaun Banega Crorepati’. After the recent Panama Papers Leak, this could be another controversial setback to Amitabh Bachchan.

According to reports, the apex court has allowed the I-T department to re-open the case and reassess Amitabh Bachchan’s income in the year 2001-2002. Amitabh Bachchan allegedly showed his income as Rs 14.99 crore for the financial year 2001-2002, while the assessing officer evaluated his income to be over Rs 56 crores, state reports. Though Bachchan had revised his income to Rs 8.11 crore later, he withdrew the revised income tax returns filed by him after that.

RELATED: Amitabh Bachchan says Amar Singh a friend, has the right to say anything

Bollywood megastar Amitabh Bachchan was then given a relief under the Income Tax Act, which is available for artistes, but the same was challenged in the Supreme Court. The Income Tax department appealed that the said income needs to either come from foreign agencies or by performing outside the country. According to Income Tax department, Amitabh Bachchan played the host in the Indian TV show ‘Kaun Banega Crorepati’ and hence his income does not fall under the realm of the said act.

ALSO READ: